BackTrader 海龟交易策略

介绍

海龟交易策略是一种经典的交易系统。

本文策略是在《Backtrader来啦:常见案例汇总》一文中提出的,我进行了复现。

本文只用于数学、编程研究,不提供交易指导。

《Backtrader来啦:常见案例汇总》一文中总结道,策略细节为:

指标计算:20日最高、最低、收盘价计算真实波动 ATR

计算20日最高、最低加,构建唐奇安通道

交易信号:

- 入场:价格突破20日最高价

- 加仓:价格继续上涨至 0.5 倍 ATR ,再次加仓,加仓次数不超过 3 次;

- 止损:价格回落 2 倍 ATR 时止损离场;

- 止盈:价格突破 10 日最低点时止盈离场;

其中:海龟交易策略之所以称之为交易系统,因为包括了加仓、止盈止损的逻辑在内。

代码实现

具体代码实现参照《Backtrader来啦:常见案例汇总》一文,融入我的量化系统,具体代码如下:

import backtrader as bt

from newstock.data.mongo.mongo_data_manager import MongoDataManager

from newstock.date.stock_date import StockDate

from newstock.market.Exchange import SZSEExchange

from newstock.market.symbol import Symbol

import pandas as pd

"""

海龟交易系统

"""

class TestStrategy(bt.Strategy):

params = dict(

N1=20, # 唐奇安通道上轨的t

N2=10, # 唐奇安通道下轨的t

printlog=False,

)

def log(self, txt, dt=None, doprint=False):

"""Logging function for this strategy"""

if self.params.printlog or doprint:

dt = dt or self.datas[0].datetime.date(0)

print("%s, %s" % (dt.isoformat(), txt))

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

# To keep track of pending orders

self.order = None

self.buy_count = 0 # 记录买入次数

self.last_price = 0 # 记录买入价格

self.close = self.datas[0].close

self.high = self.datas[0].high

self.low = self.datas[0].low

# 计算唐奇安通道上轨:过去20日的最高价

self.DonchianH = bt.ind.Highest(self.high(-1), period=self.p.N1, subplot=True)

# 计算唐奇安通道下轨:过去10日的最低价

self.DonchianL = bt.ind.Lowest(self.low(-1), period=self.p.N2, subplot=True)

# 生成唐奇安通道上轨突破:close>DonchianH,取值为1.0;反之为 -1.0

self.CrossoverH = bt.ind.CrossOver(self.close(0), self.DonchianH, subplot=False)

# 生成唐奇安通道下轨突破:

self.CrossoverL = bt.ind.CrossOver(self.close(0), self.DonchianL, subplot=False)

# 计算 ATR

self.TR = bt.ind.Max(

(self.high(0) - self.low(0)), # 当日最高价-当日最低价

abs(self.high(0) - self.close(-1)), # abs(当日最高价−前一日收盘价)

abs(self.low(0) - self.close(-1)), # abs(当日最低价-前一日收盘价)

)

self.ATR = bt.ind.SimpleMovingAverage(self.TR, period=self.p.N1, subplot=False)

bt.indicators.MACDHisto(self.datas[0])

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# 交易完成

# Attention: broker could reject order if not enough cash

if order.status in [order.Completed]:

if order.isbuy():

self.log(

"BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.buyprice = order.executed.price # 买入价格

self.buycomm = order.executed.comm # 买入手续费

elif order.issell():

self.log(

"SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.bar_executed = len(self) # 买入日期

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log("Order Canceled/Margin/Rejected")

# Write down: no pending order

self.order = None

def notify_trade(self, trade):

if not trade.isclosed:

return

self.log("OPERATION PROFIT, GROSS %.2f, NET %.2f" % (trade.pnl, trade.pnlcomm))

def next(self):

# Simply log the closing price of the series from the reference

self.log("Close, %.2f" % self.dataclose[0])

# Check if an order is pending ... if yes, we cannot send a 2nd one

if self.order:

return

# 计算加仓单位,写死10手

buy_count = 100

# 入场:价格突破上轨线且空仓时,做多

if self.position.size == 0:

if self.CrossoverH > 0 and self.buy_count == 0:

self.order = self.buy(size=buy_count)

self.last_price = self.position.price # 记录买入价格

self.buy_count = 1 # 记录本次交易价格

elif self.position.size > 0:

# 多单加仓:价格上涨了买入价的0.5的ATR且加仓次数少于等于3次

if (

self.datas[0].close > self.last_price + 0.5 * self.ATR[0]

and self.buy_count <= 3

):

self.order = self.buy(size=buy_count)

self.last_price = self.position.price # 获取买入价格

self.buy_count = self.buy_count + 1

# 多单止损:当价格回落2倍ATR时止损平仓

elif self.datas[0].close < (self.last_price - 2 * self.ATR[0]):

self.order = self.sell(size=self.position.size)

self.buy_count = 0

# 多单止盈:当价格突破10日最低点时止盈离场 平仓

elif self.CrossoverL < 0:

self.order = self.sell(size=self.position.size)

self.buy_count = 0

def stop(self):

self.log(

"Ending Value %.2f" % (self.broker.getvalue()),

doprint=True,

)

if __name__ == "__main__":

cerebro = bt.Cerebro()

print("Starting Portfolio Value: %.2f" % cerebro.broker.getvalue())

mongoManager = MongoDataManager()

df = mongoManager.getStockPeriodFromDB(

Symbol(SZSEExchange, "000001"),

StockDate.today().previousDays(500),

StockDate.today(),

)

df["date"] = pd.to_datetime(df["trade_date"], format="%Y%m%d")

data = bt.feeds.PandasData(dataname=df, datetime="date") # type: ignore

df.dropna()

# 0.1% ... divide by 100 to remove the %

cerebro.broker.setcommission(commission=0.001)

# Python 3.10 修复 module 'collections' has no attribute 'Iterable' 开始

import collections

collections.Iterable = collections.abc.Iterable

# Python 3.10 修复 module 'collections' has no attribute 'Iterable' 完成

# 策略参数优化

# cerebro.optstrategy(TestStrategy, maperiod=range(10, 31))

# 策略运行

cerebro.addstrategy(TestStrategy)

cerebro.adddata(data)

# Add a FixedSize sizer according to the stake

cerebro.addsizer(bt.sizers.FixedSize, stake=10)

cerebro.run()

cerebro.plot(style="bar", volume=False)

print("Final Portfolio Value: %.2f" % cerebro.broker.getvalue())

其中,在每次买入量中我写死了 size=10,应该是 10 手。

效果

我发现效果并不太好,每次都买在最高点上。止损看起来还行。

代码改进

参照《量化投资2:基于backtrader实现完整海龟法则量化回测》,原来在海龟交易法中,每次加仓的单位是与波动情况挂钩的。引入这部分实现。之后的策略变为:

class TestSizer(bt.Sizer):

params = (("stake", 1),)

def _getsizing(self, comminfo, cash, data, isbuy):

if isbuy:

return self.p.stake

position = self.broker.getposition(data)

if not position.size:

return 0

else:

return position.size

return self.p.stake

class TestStrategy(bt.Strategy):

params = dict(

N1=20, # 唐奇安通道上轨的t

N2=10, # 唐奇安通道下轨的t

printlog=False,

)

def log(self, txt, dt=None, doprint=False):

"""Logging function for this strategy"""

if self.params.printlog or doprint:

dt = dt or self.datas[0].datetime.date(0)

print("%s, %s" % (dt.isoformat(), txt))

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

# To keep track of pending orders

self.order = None

self.buy_count = 0 # 记录买入次数

self.last_price = 0 # 记录买入价格

self.newstake = 0

self.close = self.datas[0].close

self.high = self.datas[0].high

self.low = self.datas[0].low

# 计算唐奇安通道上轨:过去20日的最高价

self.DonchianH = bt.ind.Highest(self.high(-1), period=self.p.N1, subplot=False)

# 计算唐奇安通道下轨:过去10日的最低价

self.DonchianL = bt.ind.Lowest(self.low(-1), period=self.p.N2, subplot=False)

# 生成唐奇安通道上轨突破:close>DonchianH,取值为1.0;反之为 -1.0

self.CrossoverH = bt.ind.CrossOver(self.close(0), self.DonchianH, subplot=False)

# 生成唐奇安通道下轨突破:

self.CrossoverL = bt.ind.CrossOver(self.close(0), self.DonchianL, subplot=False)

# 计算 ATR

self.TR = bt.ind.Max(

(self.high(0) - self.low(0)), # 当日最高价-当日最低价

abs(self.high(0) - self.close(-1)), # abs(当日最高价−前一日收盘价)

abs(self.low(0) - self.close(-1)), # abs(当日最低价-前一日收盘价)

)

self.ATR = bt.ind.SimpleMovingAverage(self.TR, period=self.p.N1, subplot=False)

bt.indicators.MACDHisto(self.datas[0])

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# 交易完成

# Attention: broker could reject order if not enough cash

if order.status in [order.Completed]:

if order.isbuy():

self.log(

"BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.buyprice = order.executed.price # 买入价格

self.buycomm = order.executed.comm # 买入手续费

elif order.issell():

self.log(

"SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.bar_executed = len(self) # 买入日期

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log("Order Canceled/Margin/Rejected")

# Write down: no pending order

self.order = None

def notify_trade(self, trade):

if not trade.isclosed:

return

self.log("OPERATION PROFIT, GROSS %.2f, NET %.2f" % (trade.pnl, trade.pnlcomm))

def next(self):

# Simply log the closing price of the series from the reference

self.log("Close, %.2f" % self.dataclose[0])

# Check if an order is pending ... if yes, we cannot send a 2nd one

if self.order:

return

# 入场:价格突破上轨线且空仓时,做多

if self.CrossoverH > 0 and self.buy_count == 0:

self.newstake = self.broker.getvalue() * 0.01 / self.ATR

self.newstake = int(self.newstake / 100) * 100

self.sizer.p.stake = self.newstake

self.buy_count = 1

self.order = self.buy()

# 加仓:价格上涨了买入价的0.5的ATR且加仓次数少于等于3次

elif (

self.datas[0].close > self.last_price + 0.5 * self.ATR[0]

and self.buy_count > 0

and self.buy_count < 4

):

self.newstake = self.broker.getvalue() * 0.01 / self.ATR

self.newstake = int(self.newstake / 100) * 100

self.sizer.p.stake = self.newstake

self.buy_count = self.buy_count + 1

self.order = self.buy()

# 出场

elif self.CrossoverL < 0 and self.buy_count > 0:

self.order = self.sell(size=int(self.position.size))

self.buy_count = 0

# 止损

elif (

self.datas[0].close < (self.last_price - 2 * self.ATR[0])

and self.buytime > 0

):

self.order = self.sell(size=int(self.position.size))

self.buy_count = 0

def stop(self):

self.log(

"Ending Value %.2f" % (self.broker.getvalue()),

doprint=True,

)

效果

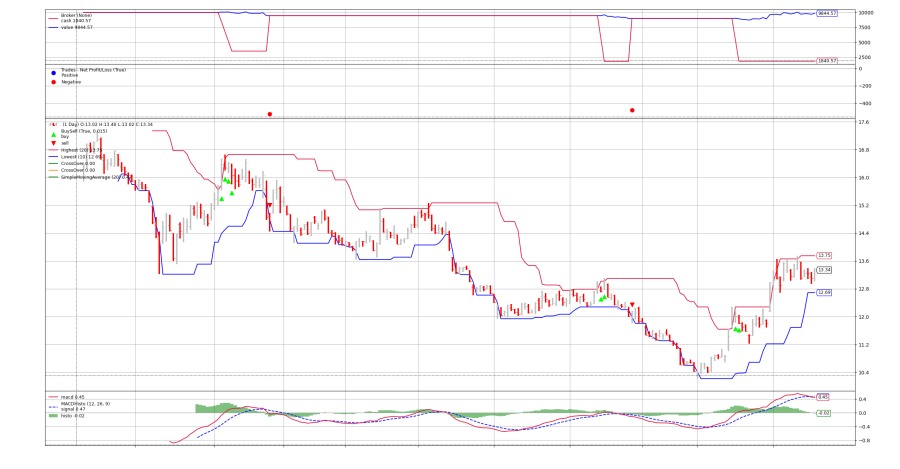

再次运行,效果如下:

从中可以看到,交易时机点不变,变化的是仓位根据波动性而变。整体上最终效果要比之前好一些。

ATR 周期改为 14

在《【手把手教你】用backtrader量化回测海龟交易策略》一文中,将 ATR 的周期改为了 14,我的执行完后,整体效果变化不明显,图就不贴了。

感悟

开仓条件:入场:价格突破20日最高价,这是一个价格突破策略,但是只适合于价格呈上升趋势的,在图中价格下跌或水平趋势是,总是容易开仓在局部高点。

更换开仓条件

灵感,更改开仓条件,变为均线金叉买入,其它不变。

其中:

- 交易变得特别频繁,其实效果也没比双均线好多少

- 海龟策略的止损比双均线止损要更加灵敏一些