BackTrader SMA 金叉策略

MA(Moving Average)指移动平均线。根据不同加权类型内部又细分为多种。本文中研究的是简单移动平均线(Simple Moving Average)。

本文只用于数学、编程研究,不提供交易指导。

代码

下面代码中 TestStrategy 策略类是通用的。

import backtrader as bt

from newstock.data.mongo.mongo_data_manager import MongoDataManager

from newstock.date.stock_date import StockDate

from newstock.market.Exchange import SZSEExchange

from newstock.market.symbol import Symbol

import pandas as pd

class TestStrategy(bt.Strategy):

params = (

("short", 5),

("long", 10),

("printlog", False),

)

def log(self, txt, dt=None, doprint=False):

"""Logging function for this strategy"""

if self.params.printlog or doprint:

dt = dt or self.datas[0].datetime.date(0)

print("%s, %s" % (dt.isoformat(), txt))

def __init__(self):

# Keep a reference to the "close" line in the data[0] dataseries

self.dataclose = self.datas[0].close

# To keep track of pending orders

self.order = None

self.buyprice = None

self.buycomm = None

sma_s = bt.ind.SMA(period=self.p.short) # type: ignore

sma_l = bt.ind.SMA(period=self.p.long) # type: ignore

self.crossover = bt.ind.CrossOver(sma_s, sma_l) # crossover signal

def notify_order(self, order):

if order.status in [order.Submitted, order.Accepted]:

# Buy/Sell order submitted/accepted to/by broker - Nothing to do

return

# 交易完成

# Attention: broker could reject order if not enough cash

if order.status in [order.Completed]:

if order.isbuy():

self.log(

"BUY EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.buyprice = order.executed.price # 买入价格

self.buycomm = order.executed.comm # 买入手续费

elif order.issell():

self.log(

"SELL EXECUTED, Price: %.2f, Cost: %.2f, Comm %.2f"

% (order.executed.price, order.executed.value, order.executed.comm)

)

self.bar_executed = len(self) # 买入日期

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log("Order Canceled/Margin/Rejected")

# Write down: no pending order

self.order = None

def notify_trade(self, trade):

if not trade.isclosed:

return

self.log("OPERATION PROFIT, GROSS %.2f, NET %.2f" % (trade.pnl, trade.pnlcomm))

def next(self):

# Simply log the closing price of the series from the reference

self.log("Close, %.2f" % self.dataclose[0])

# Check if an order is pending ... if yes, we cannot send a 2nd one

if self.order:

return

# Check if we are in the market

if not self.position:

# Not yet ... we MIGHT BUY if ...

if self.crossover > 0:

# current close less than previous close

# BUY, BUY, BUY!!! (with default parameters)

self.log("BUY CREATE, %.2f" % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.buy()

else:

# Already in the market ... we might sell

if self.crossover < 0:

# SELL, SELL, SELL!!! (with all possible default parameters)

self.log("SELL CREATE, %.2f" % self.dataclose[0])

# Keep track of the created order to avoid a 2nd order

self.order = self.sell()

def stop(self):

self.log("Ending Value %.2f" % (self.broker.getvalue()), doprint=True)

if __name__ == "__main__":

cerebro = bt.Cerebro()

print("Starting Portfolio Value: %.2f" % cerebro.broker.getvalue())

mongoManager = MongoDataManager()

df = mongoManager.getStockPeriodFromDB(

Symbol(SZSEExchange, "000001"),

StockDate.today().previousDays(300),

StockDate.today(),

)

df["date"] = pd.to_datetime(df["trade_date"], format="%Y%m%d")

data = bt.feeds.PandasData(dataname=df, datetime="date") # type: ignore

df.dropna()

# 0.1% ... divide by 100 to remove the %

cerebro.broker.setcommission(commission=0.001)

# Python 3.10 修复 module 'collections' has no attribute 'Iterable' 开始

import collections

collections.Iterable = collections.abc.Iterable

# Python 3.10 修复 module 'collections' has no attribute 'Iterable' 完成

# 策略参数优化

# cerebro.optstrategy(TestStrategy, maperiod=range(10, 31))

# 策略运行

cerebro.addstrategy(TestStrategy)

cerebro.adddata(data)

# Add a FixedSize sizer according to the stake

cerebro.addsizer(bt.sizers.FixedSize, stake=10)

cerebro.run()

cerebro.plot(style="bar", volume=False)

print("Final Portfolio Value: %.2f" % cerebro.broker.getvalue())

效果

以 sz000001 最近 300 交易日数据为例。

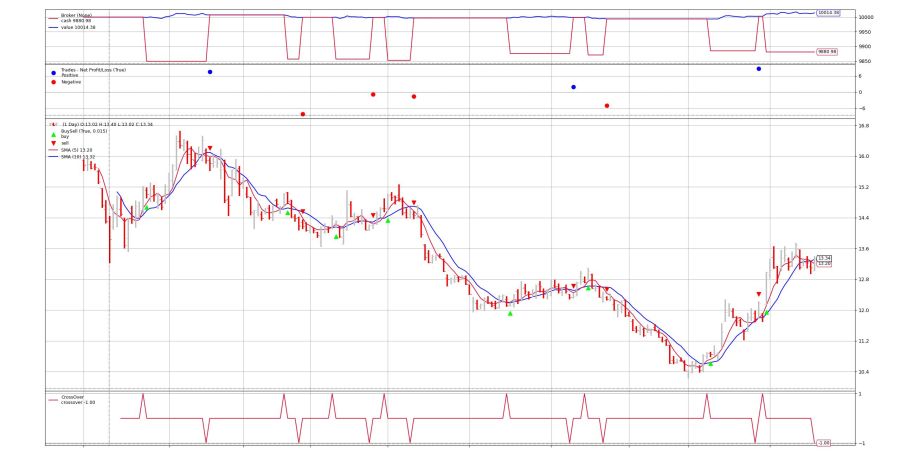

快线5 慢线10

可以看到,最终没有赔钱,但也没有挣钱。

从共交易了 7 次,3 次是成功的,4 次是亏损的,盈亏幅度都挺大。

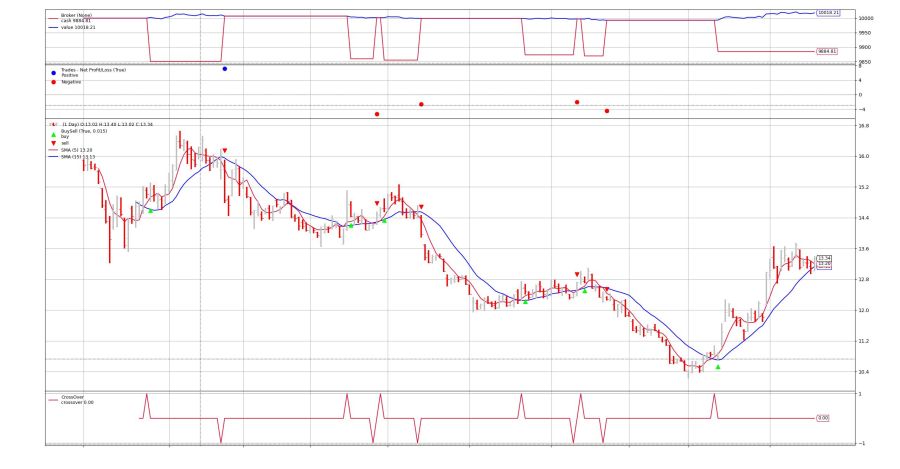

快线5 慢线15

交易次数变少,对于盈利没有影响。

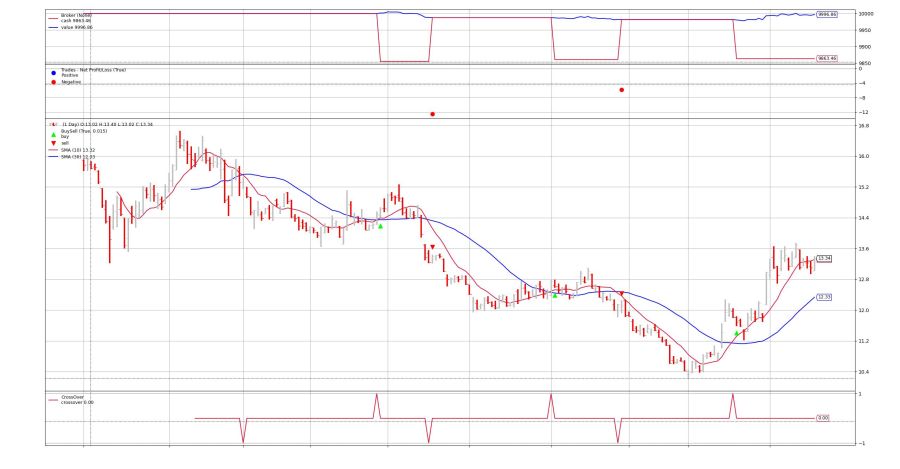

快线10 慢线30

把均线放慢试一下。

均线放慢后,收益下降(下降了一点点)。看到交易频率进一步下降,但全是失败的。

感觉 SMA 更加适合于作为一个短线指标。